Disclosure: I held $TSLA and $ARKK stock for many years but have pretty much sold off all my individual stock holdings for $VOO and $VT. I don’t currently hold any $TSLA shares. Nothing here is investment advice.

Hi everyone!

A lot of the posts that I see about Tesla and $TSLA on LeoFinance and Hive tend to be about the potential for Tesla and hypothetical scenarios, and I wanted to look at the situation Tesla finds itself in before their earnings call on Tuesday.

Over the last 5 years, $TSLA has been an incredible stock… it was the 2nd most shorted stock (after Apple) on the NYSE and those short sellers were funding hit piece after hit piece after hit piece… but Tesla had some incredibly diamond-handed investors and the release of the Model 3 and the Model Y saw Tesla become the biggest automotive manufacturer in the world by marketcap.

Unfortunately, the last year has not been great for the company…

… and I expect Tuesday’s earnings call to tank the stock even further… but let’s look into why:

Hybrids grabbing EV marketshare

I have to admit, this caught me by surprise.

I personally don’t think about hybrid (can run on both electric batteries and petrol/gas) vehicles all that much, to me they’re not a great option because if you never plug it in then the weight of the battery makes it super inefficient, and if you only use the battery then you have reduced range and you’re lugging around a fuel tank.

The thing that I keep forgetting about is that EVs are really hard if you don’t have your own garage or driveway. If you do, they’re amazing, you plug it in every night and don’t think about it, but if you don’t have that option, it’s a massive hassle. You have to find external chargers, and while this infrastructure is continually being built out, there can still be long wait times.

A hybrid reduces the range anxiety risk.

You can see in Europe, for example, that the market share for Hybrid vehicles grew while all other types of vehicles shrunk:

Even if charging infrastructure is absolutely everywhere, and charging EV batteries gets really quick (which are both likely to be true in the coming years), I do think that people who live in apartments and/or park on the street are likely to continue to purchase hybrid vehicles, even as I expect the price of petrol/gas to increase over time as demand cools (the drilling, refining and transport of gas are essentially fixed costs, so as demand drops, that cost gets shared amongst fewer people).

Model 2 versus RoboTaxis

Here is an excerpt from the Tesla Q4 Earnings call on Jan 24 2024:

Thank you. Let’s go through investor questions. Question number one is from Michael: Given that you move the start of the next-generation compact vehicle production to Austin, has the timeline improved so that we might see the next-generation platform vehicles in 2025?

Elon Musk — Chief Executive Officer and Product Architect

We — I mean, I won’t certainly say — say things with — they should be taken with a grain of salt since I’m often optimistic. But, you know, I don’t want to blow your minds, but I’m often optimistic regarding time. But our current schedule says that we will start production toward the end of 2025, so sometime in the second half. That’s just what our current schedule says.

It seems a month later, though, plans for Model 2 were scrapped. [Source]

The Model 2 was supposed to be about 22% profitable…

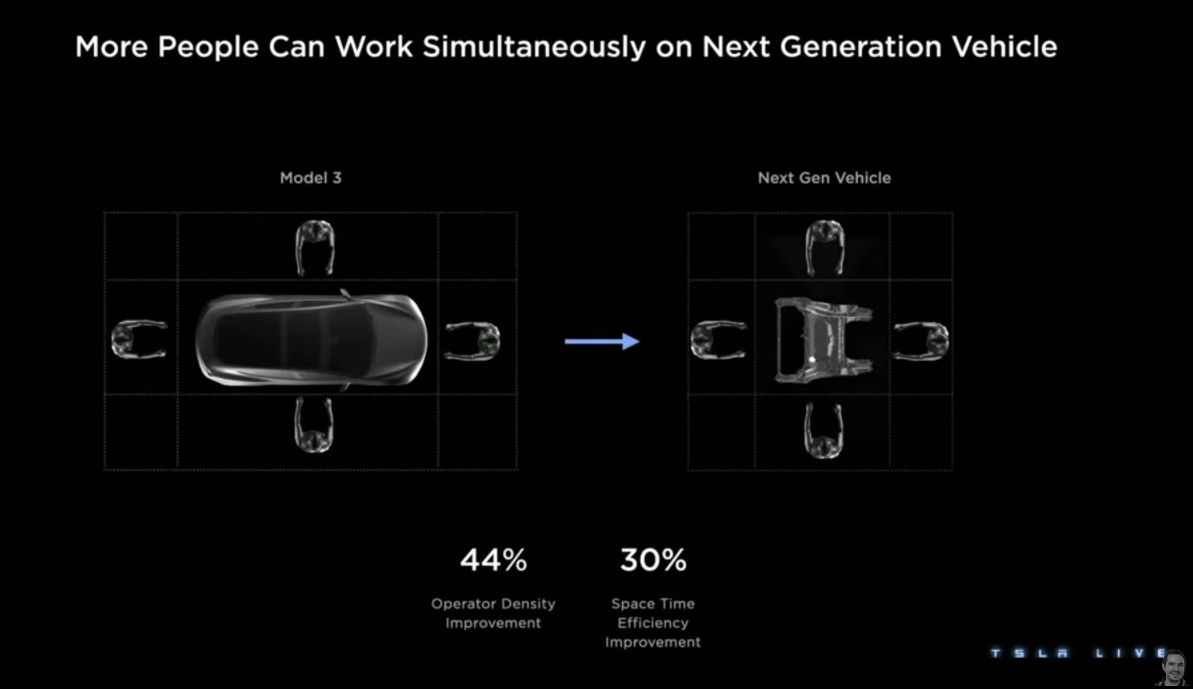

The 22% profitability was supposed to come from their new method of manufacturing called “unboxed production” that they unveiled in the March 2023 Investors Day:

I don’t know if they couldn’t get this new manufacturing process to work, or if Tesla wasn’t sure it could compete with the BYD Seagull that has a price around $10,000 USD (which won’t be available in the US anytime soon) and didn’t think they could compete:

If Tesla aren’t going to make a Model 2 aimed at $25,000, then what are they going to do?

Well, I’m sure you already know because I chucked it in the title, but the information we do have is a Musk tweet “Robotaxi unveil 8/8”. [Source]

The problem is that regulators haven’t been contacted by Tesla yet [Source] so to me that suggests Tesla might unveil a Robotaxi concept on 8/8, the production of which would still be 4 or more years away.

FSD (Full Self Driving), the technology that I assume will drive the Robotaxis is nowhere near ready, as Tesla owners post videos illegal maneuvers and near-misses every day. Most Tesla owners don’t use FSD because they either find it too expensive or too stressful. This is understandable because the driver never knows what FSD will do and if FSD looks like it might blow through a stop sign (I’ve seen so many videos of this happening) the driver doesn’t know if it will, or stop at the last moment. I saw a video today of FSD rolling along and then suddenly cross the line and dive into an oncoming vehicle. The driver disengaged, but, um, wow. No thanks. [Source]

Tesla owners have the choice between purchasing FSD for $12,000 or a monthly subscription of $199… except they recently halved that subscription to $99 a month… meaning it’ll take 121 months (10 years) to reach that $12,000 price.

Demand for Tesla vehicles is dropping

Not only are Hybrid vehicles doing way better than expected, but demand for Teslas specifically are dropping.

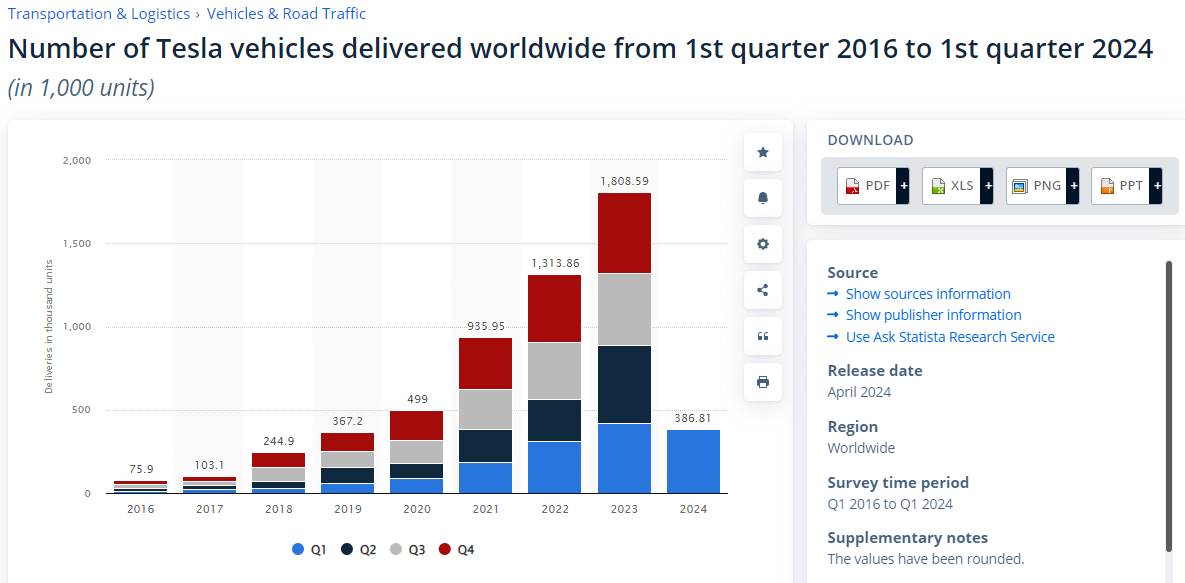

Today, Tesla dropped the list price of the Model Y, S and X by $2,000 today [Source] and by 14K yuan in China overnight, in order to increase demand, which was lower (assuming deliveries = demand, which isn’t always the case) than Q1 2023:

Given the increased competition of exciting new EVs as more established automotive manufacturers start fine-tuning their processes and technology…

… I think Tesla is going to be in for a continually tough time, especially in China as BYD is aggressively subsidized by the CCP. It’s not impossible that they pull themselves out of this tailspin but I do think it’s unlikely.

Cybertruck has been so much trouble

All Cybertrucks had to be recalled this week because the panel on the accelerator could slip down (because they used soap to slide it on?) and jam the accelerator on at full throttle. Wild.

The big news though, was that under 4,000 Cybertrucks had been recalled, which is a lot less than people had guessed had been delivered. Rumors suggest that Cybertruck deliveries have been halted for the moment. We’ve all seen the quality issues with panels not being flush and sharp edges everywhere, but the Cybertruck forums are absolutely full of people complaining about their truck just stopping, or the screen going blank, or a trillion other issues.

It’s been extremely hard to produce, won’t be profitable for a long time and honestly is just too niche to really help Tesla in any way.

Elon’s politics

Personally I believe that Elon has been supporting Trump, DeSantis (and maybe even RFK Jnr) to help with:

- 60+ lawsuits for FSD/Autopilot

- DOJ probes into FSD

- EPA violations at the Fremont plant

- Racial discrimination class action suits.

There’s also rumors that the 10%+ of Tesla staff laid off this week included people who were trying to unionize so we’ll have to see if that violates the US National Labor Relations Act.

I suspect this was a big reason for purchasing Twitter… but because of his obvious lean to the right, he’s killed a lot of Tesla’s brand value:

Among 2022 model-year buyers, Democrats made up 40% of Tesla customers and 39% in 2023, according to Strategic Vision’s surveys. Things began to change in the 2024 model year survey, which began in October. The makeup of Democrats fell to 15% while Republicans jumped to 32% and independents swelled to 44%.

Left-leaning Americans traditionally list environmental concerns as a reason for purchasing an EV (as opposed to saving money on fuel), but now that Elon’s politics are not something they want to support, and there are lots of alternatives, I personally don’t see how demand for Tesla’s don’t continue to drop.

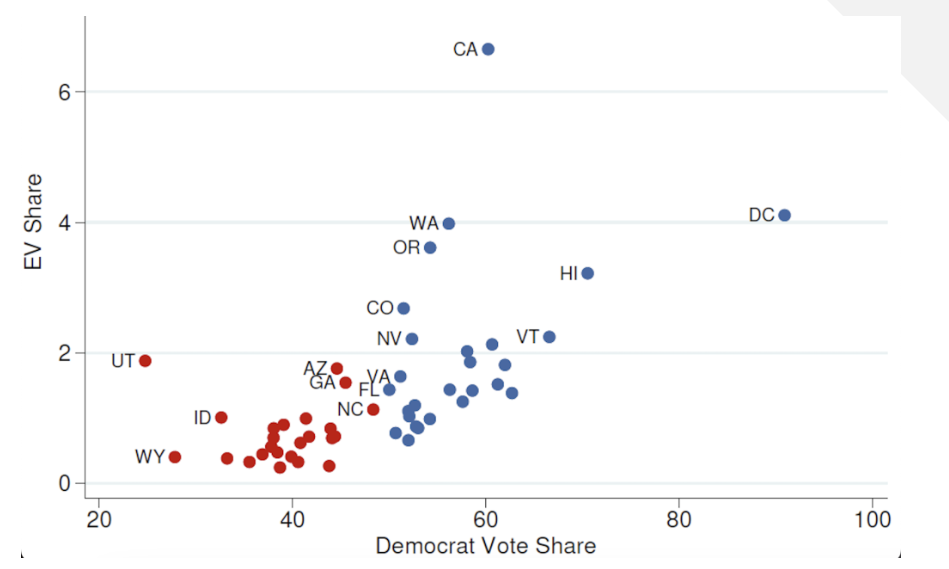

Right-leaning Americans haven’t been adopting EVs at the same rate. The below graph is unfortunately only from 2012 to 2022, but you can see the clear split between Democratic and Republican states:

Gigafactories

Gigafactories and vertical integration make a lot of sense when you’re growing like crazy, but if demand drops off because of competition, politics, interest rates, etc, then suddenly those factories absolutely bleed money. Germany Gigafactory was so expensive to build within the EU regulations, and I’m now not sure of the status of the Mexico Gigafactory and the Indian Gigafactory, but spending money on new factories doesn’t make sense if demand drops off.

The problem is that Gigafactories are expensive to build, expensive to run, and expensive to retool (ie, change production lanes from one vehicle to another) so Tesla potentially is now slower to react to market dynamics than a lot of more established auto manufacturers.

The “more than 10%” Tesla layoffs of this week is likely to mean that these gigafactories can’t be utilized as efficiently as before, meaning the profit margin per vehicle may go down.

Summary

The next earnings call on Tuesday for Tesla is going to be so interesting… it seems like it’s going to be all bad news… but Musk is an expert stock-pumperupperer so he could say something that could send the stock parabolic, but if it turns out to be not true, or delayed, I imagine that’ll send the stock absolutely plummeting.

Tesla stock has always been known as a growth stock, with a lot of hypothetical scenarios priced in (Model 2, all Teslas becoming Robotaxis, etc) but once sales and deliveries are no longer growing, and FSD doesn’t seem to be improving, (ie, people claim Tesla is not an automotive stock but an AI stock) then the priced in growth disappears and Tesla stock is then overvalued.

Meaning, the 40% YTD price drop gets so much worse:

Be careful out there!

Thanks so much for reading!

Please note : The above post may contain affiliate links.

Below are some product referral links that I love and will benefit us both if you’re interested.

Splinterlands – A super fun blockchain card game that I play almost every day.

Fathom Analytics – Cookie notices no longer needed since Fathom doesn’t track data. You can see this site’s analytics right here.

Coil – A $5 USD monthly subscription fee provides you access to a ton of content and sites in a way that fairly rewards the creators of that content.

Exxp – The WordPress App to link your blog to the Hive blockchain.

NomadTask – Earn for completing online tasks like following accounts or completing reviews.

MINT Club – Create your own Smart Media Tokens with no coding required.

GALA Games – Gala is creating a whole platform of blockchain games. Definitely excited about Mirandus, Townstar and SpiderTanks.

MCO – Use my referral link https://crypto.com/app/9h9jnlxun9 to sign up for Crypto.com and we both get $25 USD.

Aptera – Get 30% off the reserve price for this incredible electric vehicle. (My post)

Update :

It must have literally only been a couple of hours after I wrote this:

Tesla owners have the choice between purchasing FSD for $12,000 or a monthly subscription of $199… except they recently halved that subscription to $99 a month… meaning it’ll take 121 months (10 years) to reach that $12,000 price.

that Tesla now dropped FSD to $8K.

I had checked the $12K price on Tesla.com before I included it, so they’re pushing FSD hard. Must be pretty frustrating for people that already paid $12K or even $10K a few years ago.

The problem is that FSD is too scary for most people. It just takes one phantom braking situation (where the car breaks hard for no obvious reason) to put people off it completely.

If the Earnings Call on Tuesday doesn’t have massive delivery numbers, I really do think Tesla is in trouble.