Disclosure: I held $TSLA and $ARKK stock for many years but have pretty much sold off all my individual stock holdings for $VOO and $VT. I don’t currently hold any individual $TSLA shares outside of S&P 500 EFTs and whatever is included in 401K/Superannuation accounts. Nothing here is investment advice.

Hi everyone!

Freakin’ wow!

3 days ago I warned @scaredycatguide that $TSLA shares were about to plummet due to poor delivery numbers, and instead the price shot up like crazy.

While the markets seem irrational, I think there is some logic behind this rocket trajectory and why I think it might be short-lived. This is an continuation of the posts I’ve made previously:

$TSLA by the numbers – April 22nd 2024

$TSLA by the numbers – follow up! – April 27th 2024

The annoying thing about my exchange with @scaredycatguide is that I was right. The Tesla delivery numbers were disappointing.

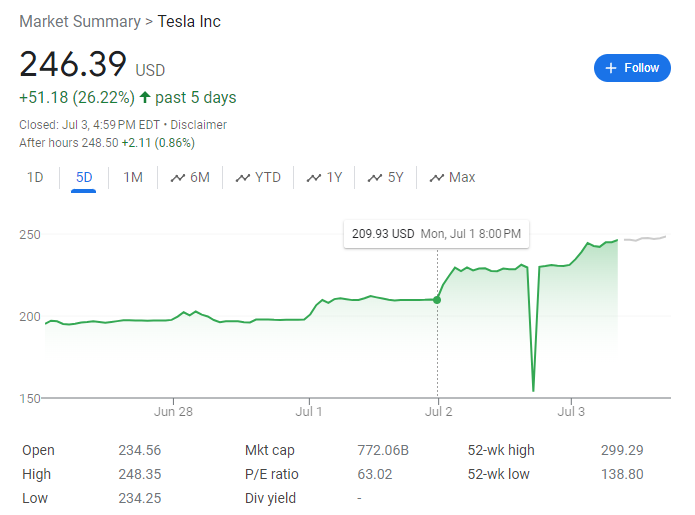

Tesla saw its Q2 global car sales fall by 4.8% (Year over year) after an 8.5% YoY drop last quarter. Sales have declined 2 consecutive quarters (for annual sales) for the first time ever… and the stock market responded like this:

The price of the stock has gone up 25% this week, both in anticipation of the delivery numbers and the actual disappointing delivery numbers.

So, what happened?

There are people whose job it is to estimate how well companies are doing before those companies have to report how well they’re doing… let’s call these people analysts. They do this so they can either sell those estimates, or advise the company they work for, so shares can be bought or sold before the rest of the market can react to the actual company reporting.

Fortunes are made and lost on the stock market, not because of what happens, but because of reactions… the buying and selling based on reactions to news, rumours, tweets, etc.

In July 2023, the general consensus of analysts predicting Tesla’s deliveries (ie, the number of cars that get to customers) was around 580,000ish, in January 2024, analysts downgraded those predictions to 540,000ish, in early April 2024 they downgraded again to around 480,000ish and in mid-April 2024 they downgraded again to 430,000ish.

Specifically the estimate on Tesla deliveries for Q2 2024 was 433,397 (very precise, but they go off data like registrations, etc) and it actually ended up being 443,956.

If analysts didn’t drop their consensus in mid-April, Tesla would have missed by 7%, but instead they were 2.4% above consensus (which again, is just people outside of Tesla guessing) and the share price went parabolic.

Equities (aka the stock market) is such a weird world. I personally find it upsetting just how much money is moved around based on guessing, vibes and emotional reactions.

Adding to the parabolicness was a short squeeze, with Tesla short sellers losing $3.5B in two days [Source].

Tesla shares have gone up 73% since April 2024, which is just absolutely massive for a company that is losing market share quarter over quarter.

Tesla’s Earning Call for Q2 2024 is scheduled for July 23rd 2024… and I expect the numbers to be really bad… but the stock will likely go up anyway… all in anticipation for the Robotaxi unveil on August 8th 2024… which I think will probably be really disappointing (I expect any actual product to be years away but I’m sure there will be promises of a much sooner release schedule).

Tesla’s Q2 Earnings Call

In Q2 Tesla delivered 443,956 vehicles, but built 410,831.

It’s estimated that building 410K vehicles only utilizes 68% of their manufacturing capacity, which is well below break-even (you still have to pay for 100% of the manufacturing capability; buildings, people, logistics) so they are likely burning cash right now.

The demand for Tesla vehicles has shrunk considerably. Elon is clearly supporting Trump… and Trump continuously rails against renewable energy and EVs. I think Elon is hoping Trump can “disappear” a whole lot of court cases Elon has coming up, but it’s tainted the brand and driving a Tesla is now pretty embarrassing.

The love that people have for the ID.4, IONIC5 (&6) and EV9, as well as BYD absolutely dominating the EV market (I think they’ll deliver more than Tesla next quarter), Tesla’s main selling point was its supercharger network, and Elon famously fired the entire team (I’m sure they’ve been mostly brought back now). People are still have range anxiety for EVs, particularly in Australia and the US (geographically huge countries) and so hybrids are still selling well too… all of this is not good for Tesla’s demand.

To shift vehicles in Q2, Tesla had a bunch of discounts and low-interest-rates to entice customers… which has clearly been successful… but that will clearly erode revenue and profits.

The low utilization of manufacturing capacity, and the discounts on vehicles means that each vehicle costs more, and is also bringing in less money. Not great.

As more competitors release new and more exciting EVs, I suspect Tesla will need bigger and bigger discounts to sell their vehicles. They likely still have 100K vehicles in their inventory, which is massive and further proves the demand just isn’t there at the moment.

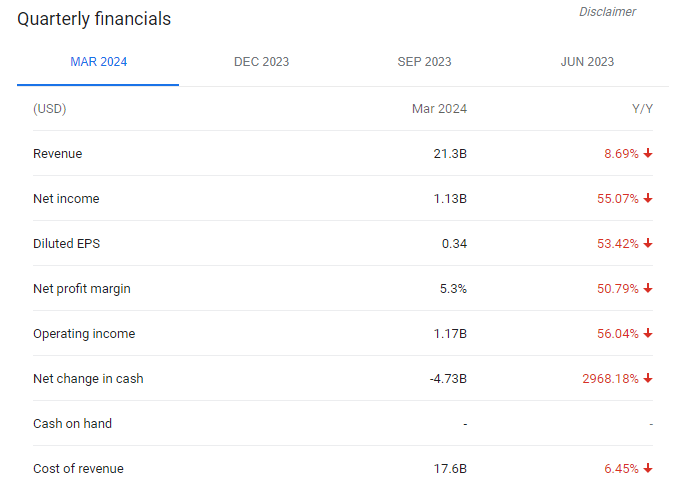

Tesla’s Earning Call for Q1 2024 was horrendous:

Apparently Tesla’s Q1 Results included a $700m of deferred FSD revenue. Tesla has been collecting FSD revenue for 10ish years, but only put it on the books last quarter. I suspect this might have been a one time deal, so I’m expecting the Q2 quarterly financials released in a couple of weeks to be worse than Q1.

Why doesn’t the stock price reflect the financials?

Tesla’s stock price is way higher than it should be when you look

Toyota’s share market cap is $325.31B USD while Tesla’s market cap is $772.06B USD – despite Toyota generally selling 4 times more vehicles in the US than Tesla.

Of course, every Tesla fan says that the Tesla share price is high because Tesla is an AI Robotics company not an auto company… which while could be true in the future, is not true now because Tesla hasn’t made any money from AI or Robotics. It’s made money from FSD, but FSD is not AI, it’s a neural network, and no Optimus units have been sold… and I think they are probably years away.

Given that Tesla seems to be buying NVIDIA hard drives for Elon’s other company xAI, I don’t think Tesla will ever be known as an AI company. Obviously the inference (using the hard drives in Tesla vehicles to compute for AI) has been suggested, but I don’t believe this is a serious workable profitable idea for Tesla.

I’m also doubtful that the Robotaxi/Cybercab to be announced on the 8th of August will be a profitable venture for Tesla either.

Google’s Waymo is apparently getting pretty good (I’d be interested to try it out, but I wouldn’t touch Cruise), but as a venture it still might be years before it is actually profitable. Waymo taxis have an estimated $100K of robotic sensor equipment on them and seem to be reasonably safe.

Tesla vehicles were supposed to turn into Robotaxis and earn the owners passive income, but FSD is continuously problematic and I’m not sure it will ever dramatically improve, because, as far as I understand, it’s never being coded to get better, it just receives more and more data… which possibly just means it continually swaps out one problem for another, forever.

Regardless, if I was a Tesla owner, I’d probably be annoyed at the Robotaxis announcement in August because it sounds like Tesla will now compete with its own customers, and would likely prioritize their own Robotaxis above their customers… if they can ever get it working.

FSD was recently renamed to Supervised FSD, the driver is still expected to be in control at all times. This means the driver is legally responsible for any mishaps. Google is currently responsible for any Waymo mishaps… is Tesla ready for this big jump in accountability? It could get very expensive.

What happens next?

I’m honestly expecting the Tesla stock to plummet either after the Earnings Call or after the 8th of August.

It could very well not because Tesla has a super high retail investor percentage who might not understand the risks… but I expect a stock crash at some point… which will affect the S&P500 and make headlines everywhere.

I assume at some point reality has to catch up to the vibes… but who knows, Elon is the best stock pumper in the world… maybe he can keep it up indefinitely… but I imagine he’ll get bored of Tesla soon now that it’s no longer in its growth phase.

What do you think? Am I very wrong (again)?

Thanks for reading!

Please note : The above post may contain affiliate links.

Below are some product referral links that I love and will benefit us both if you’re interested.

Splinterlands – A super fun blockchain card game that I play almost every day.

Fathom Analytics – Cookie notices no longer needed since Fathom doesn’t track data. You can see this site’s analytics right here.

Coil – A $5 USD monthly subscription fee provides you access to a ton of content and sites in a way that fairly rewards the creators of that content.

Exxp – The WordPress App to link your blog to the Hive blockchain.

NomadTask – Earn for completing online tasks like following accounts or completing reviews.

MINT Club – Create your own Smart Media Tokens with no coding required.

GALA Games – Gala is creating a whole platform of blockchain games. Definitely excited about Mirandus, Townstar and SpiderTanks.

MCO – Use my referral link https://crypto.com/app/9h9jnlxun9 to sign up for Crypto.com and we both get $25 USD.

Aptera – Get 30% off the reserve price for this incredible electric vehicle. (My post)

[…] $TSLA by the numbers – April 22nd 2024$TSLA by the numbers – follow up! – April 27th 2024$TSLA by the numbers – Insanity Edition – July 4th 2024 […]