Welcome to my Not financial advice – July 2022 post!

Hi everyone!

Unfortunately, the things I’ve predicted in my previous posts have all come true… which is a bummer because I was predicting a bummerbear.

If you feel so inclined, you can check my work here:

Not financial advice – June 2022

Unfortunately squared, I don’t have a ton of good news for the next couple of months.

Firstly, the Russian invasion of Ukraine is really going to be start to be felt all over the world. A lot of countries were already struggling with their own crops due to climate change induced famine. These countries were already massively relying on the grain to come out of Ukraine and Russia. Half of Ukraine’s grain fields are now under control or under fire by Russian forces, and due to the Russian naval forces blockading the ports in Odessa, the remaining grain for export can not leave Ukraine and will essentially just rot.

Lots of countries are in real trouble of not being able to feed their populations.

Add on top of that, the lack of oil and gas out of Russia is going to make things extremely difficult for Europe in winter.

I can’t even imagine how to calculate the millions of lives across the world Putin will impact.

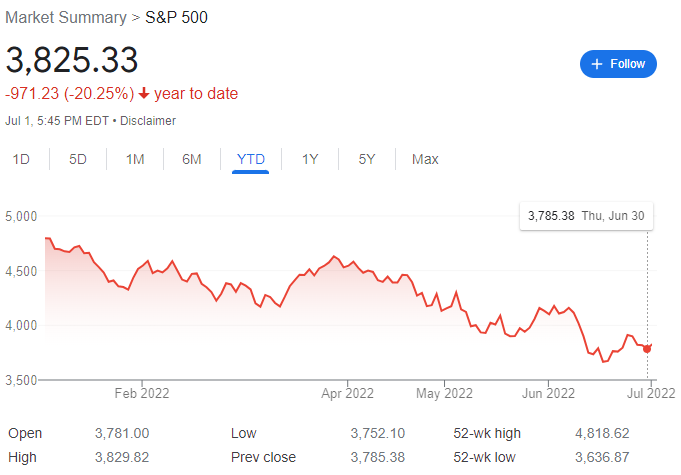

What this means is that government spending and capital that would normally go into infrastructure projects that makes things more efficient (energy projects, roads, public transport, etc) now have to go into securing food and power for citizens. The world is in crisis mode (war, famine, plague) and so investments are obviously going to sink as capital gets routed elsewhere…. as we can see…

On top of all of that… the US Fed is still reacting to inflation.

Remember, inflation is a reactive indicator… it measures what has been happening, but it doesn’t give any indication on what might happen.

This is the current inflation rate in the US:

Don’t get me wrong, inflation is a super big deal… not only does it make it more expensive for people of the world to literally live, but it prevents companies from engaging in efficiency projects… and if inflation lasts for long enough, then workers require raises just to survive, which raises company costs, which raises the price of their products… which means workers then require more money just to survive and the cycle continues. The US Fed needs to kill inflation dead… and they need to keep on stomping on it until they are sure it’s dead.

The problem is… deflation is also super problematic. Deflation causes prices to drop… which is good when we’re talking about food, energy, etc… but if people think that prices will drop further, then they’re not going to buy bigger items today, so the economy stalls. When people aren’t buying stuff, then companies have to slash their prices to be more competitive… which again, sounds good, but people still won’t buy if they think prices will go down more… etc.

At the moment, prices of lots of things are high, especially for food and energy due to climate change and Putin. When there are high prices… everyone only buys what they need to… Demand drops off, and companies then have to reduce their prices to entice people to buy their stuff. Inflation can often come down by itself through the demand destruction that high prices cause… but now with the US Fed doubly stomping on it, I mentioned this last month, but I still think we’re going to see inflation come right down very quickly.

There is another reason prices are going to drop…. the ol ‘supply chain issue‘ excuse. During the pandemic companies starting buying way more stock because everything was so hard to come by… and at the start of the pandemic so much stuff was being bought (stimulus and people weren’t spending money on services, normally 70% of expenses)… but now people have stopped buying, and companies have so much stock they’ve been hoarding. They don’t want to pay for storage costs…. so… lower prices.

The US Fed is aiming for interest rates of 3.5%. This is the history of the US Fed rates:

3.5% seems absolutely bonkers to me… the markets have seriously reacted to sharp rate increase already, and even though the markets aren’t real life in the slightest, they do affect Boomers who want to retire. The less Boomers are able to retire, the more economic pain this causes all the younger generations who not only want those opportunities, but would also bring fresh leadership into companies, governments, etc. We can all see that Boomers continuing to make big decisions for everyone else is…. not good.

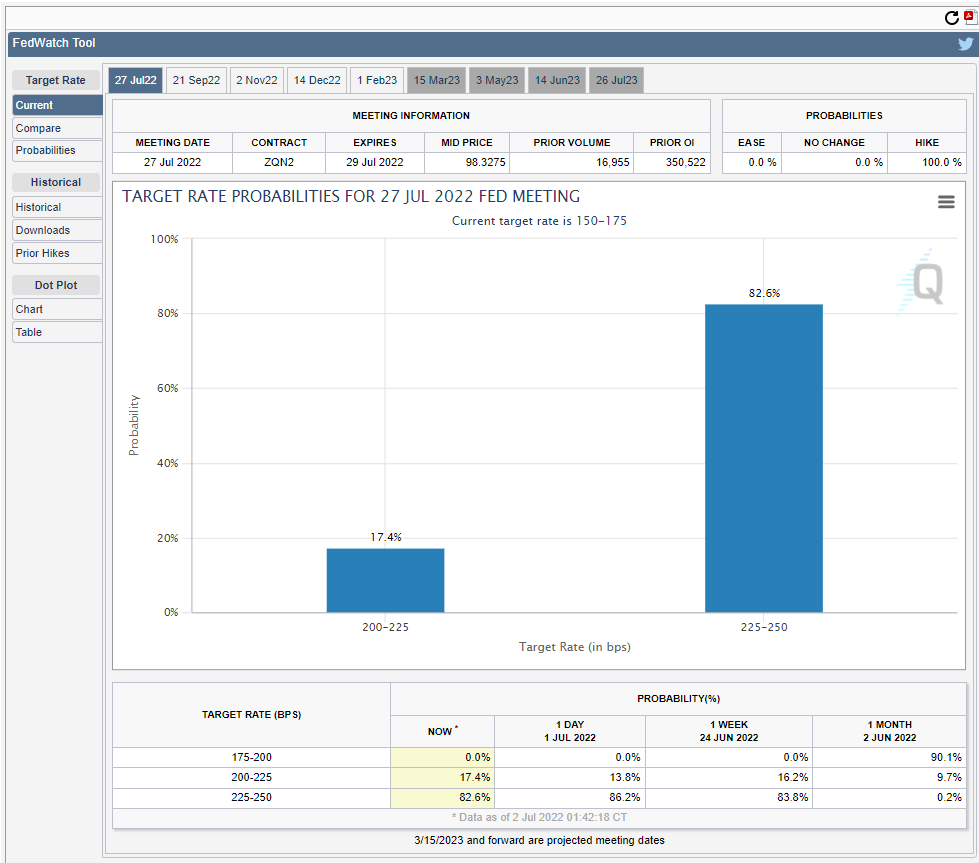

You can see that the majority of the market is expecting the US Fed to announce another 75 Basis point rate hike in 24 days (bringing interest rates to 2.5%):

If that happens… we can expect stocks and crypto to sink further.

I think it’s very likely that the US Fed will raise interest rates again in July, and stocks and crypto will drop down more. As long as the US Fed continues to chase a 3.5% interest rate, we’ll be in a bear market. The market still won’t recover until it truly believes the US Fed will do absolutely nothing for a long time or will start Quantitative Easing again (buying up assets).

The thing is… a bear market isn’t bad. It depends where you are in life.

It means that people like you and me can pick up assets (crypto, stock, real estate, bonds, commodities) at cheaper prices. Sure, we feel better looking at green candles… but since we’re not looking to retire anytime soon, red candles will help us build our long term wealth for our own retirements.

If the US Fed reverses course to bail out Boomers, then we’ll see green candles all over the place… but we’ve lost our opportunity to buy in cheaply.

The US isn’t in a great situation. Younger generations are super struggling to make ends meet and are hamstrung with huge debt. If Boomers can’t/won’t retire and are living longer, then nothing gets passed down to help younger generations over these hurdles (ironically, at the moment, Boomers are mostly the only ones inheriting anything from the older generation).

Other countries are in similar situations, obviously, the younger generations in the US are saddled with much crippling debt from education and health care.

So what can we do?

Firstly, accept that the US is in a recession… just like China and Europe.

This means cutting your costs and, if possible, saving money just in case you lose your job or your hours get cut back. If you can think about planting any sort of food, definitely look into it, just to ease some of the pressure we’ll need over the next year or two.

Secondly, once you’ve saved enough money to keep you afloat for a few months in a worst-case scenario (the US employment numbers are going to reverse for sure… expect lay offs), then you can start to look for some bargains… be it stocks, real estate or crypto. Don’t forget that it’s in bear markets that the big players make their big moves, and so you too should keep an eye out for assets that you think will increase in price in a few years, or ideally, a few decades.

I don’t think we’ve hit the bottom of anything just yet… and I’m not sure if we’ll be able to tell when it is… so just try to Dollar Cost Average (DCA) in… which means, decide which assets you will want in the long term, and buy them in regular small amounts over time. It’s far less risky than trying to time big transactions exactly right.

So…. save a buffer, pay off debt and once that’s done, start buying small amounts of assets each month or pay period.

Given that we’re in a bear market for a year or so, the other thing you can do is accumulate crypto through effort.

Things like gFam.live, Splinterlands and Hive are great ways to do this.

On gFam and Hive, you can create content for tips and upvotes. During a bear market, where the currency is worth less, you’re likely to earn more currency… it’s a great way to stock up and hold on for when we’re back to a bull market.

On Splinterlands you can their currency (DEC) for each game you win… and you can win loot chests with cards or other prizes at the end of the day and the end of the season (between 12 and 15 days). The cards you win can be levelled up to become more powerful, or you can sell them for currency.

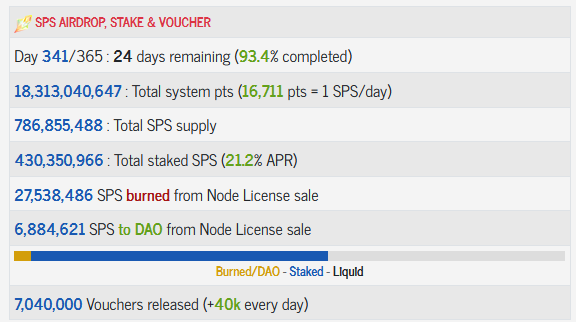

You can also receive another currency SPS for holding the Splinterlands digital assets like the cards… although I will warn you that the SPS airdrop only has a few days left…

24 days left and counting…

One thing I find particularly interesting about the Splinterlands game – is the amount of effort the Splinterlands company puts into creating value for the community… but that the company doesn’t actually directly benefit from.

Take the Riftwatchers card edition which is 55% complete and due out in sometime in the next 3 months.

Riftwatchers will be a small card pack edition… so, the last version like this was DICE which has 23 cards in it. So, 23 new cards (although probably more) that will be balanced and exciting and add more strategic elements to the game… and the Splinterlands company won’t make a dime from it.

Riftwatchers will be only purchasable with the SPS currency (and maybe vouchers I think). I believe some of the SPS will be burned and some will go to the Splinterlands DAO.

We can see from here:

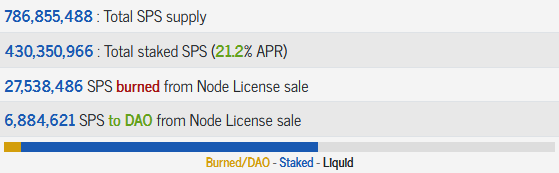

That from the Node License sale 27M SPS was burned already and 6.8M SPS was put in the DAO.

The Splinterlands DAO Foundation will be a community run enterprise, where people will be able to vote on what is done with that SPS…. and those votes will be weighted against how much SPS people have staked in their accounts. Through the normal SPS distribution, the Splinterlands DAO Foundation will have 300M SPS given to it over 5 years… plus whatever it receives from Nodes, Riftwatchers, etc. It’s likely to have about 106M in it so far.

Since the Splinterlands DAO Foundation will be community-run and voted on, I’m super sure that short-sighted people will vote for the SPS in the DAO to be burned.

Their reasoning will be that if demand for SPS stays the same… and supply is reduced by 300M+ then the price may rise…. and they’re right, it may do.

However, it may not… with the eventual SPS amount available after 65 months being 3,000,000,000, burning 10% would be a total shame.

Say there is 106M in the Foundation at the moment… that’s over $500K USD. The current total supply is 818M so burning it would delete an 8th of the supply… however, this may create a small uptick in demand as people respond to that action, which may increase the price momentarily and make everyone feel good about their onscreen numbers… but since it’ll just be a small demand spike the price would likely drop back to where it is.

Instead of a short-term action which may or may not work… I think it would make way more sense to sell that SPS to the market (eeeek, I know, increase supply, yikes) and then take that USD and use it to market the Splinterlands game even more than it already is.

You can reduce supply, sure, but it’s always better to increase demand.

Increasing the player base of Splinterlands will increase the demand for cards… for DEC… for SPS… for Hive accounts and Hive resources and increase competition, increase battles per month, increase daily usage… and most importantly, increasing demand also increases demand.

I know, it sounds like I’m circle-talking… but you know how in shops, people notice a crowd? If you see a crowd of people, you’re definitely curious about what’s going on. The more people that play Splinterlands, enjoy the game and buy into the ecosystem, the more people will recommend it to their friends (especially with affiliate links) and generally increase the buzz around the game.

Marketing can come in all different ways… it could be commercials or endorsements. or paying influential Twitch creators to bring it to their audiences, or using the funds to add functionality that would help onboard or remove some of the complexity to the game.

Using the funds to increase the user base is a win win for the long term. Burning the SPS only potentially benefits current SPS holders. Increasing the user base helps current players and introduces new players to a whole new world of #play2earn which could change their lives or just provide them with a challenging strategic game to play.

I still play Splinterlands every day… and sometimes I’ll be playing another game and then think to myself… why am I even bothering, I’m not even earning anything, and jump back into Splinterlands. I play both Clash Royale and Brawl Stars, on my phone, and I have for years and seen the games really mature… but if I stop playing tomorrow, all I have is memories. I’ve never spent any money on either game… but most of my clanmates regularly do…. that money is gone, which is fine, it’s their entertainment. If I stop playing Splinterlands, I can sell all my cards, DEC, SPS, potions, packs, etc and actually leave with more money than I put into it.

That simple fact alone is super motivating… and each loss is motivating to be more strategic next time. There’s so much to be excited about with Splinterlands… it’s honestly going to be a great way to spend the bear market.

Thanks for reading my Not financial advice – July 2022 post! I super appreciate it!

Please note : The above post may contain affiliate links.

Below are some product referral links that I love and will benefit us both if you’re interested.

Splinterlands – A super fun blockchain card game that I play almost every day.

Fathom Analytics – Cookie notices no longer needed since Fathom doesn’t track data. You can see this site’s analytics right here.

Coil – A $5 USD monthly subscription fee provides you access to a ton of content and sites in a way that fairly rewards the creators of that content.

Exxp – The WordPress App to link your blog to the Hive blockchain.

NomadTask – Earn for completing online tasks like following accounts or completing reviews.

MINT Club – Create your own Smart Media Tokens with no coding required.

GALA Games – Gala is creating a whole platform of blockchain games. Definitely excited about Mirandus, Townstar and SpiderTanks.

MCO – Use my referral link https://crypto.com/app/9h9jnlxun9 to sign up for Crypto.com and we both get $25 USD.

Aptera – Get 30% off the reserve price for this incredible electric vehicle. (My post)